Asimudeen Sahabudeen

Description

Hello! I’m a Data Enthusiast with a passion for uncovering insights from raw information and using them to drive decision-making and innovation. What fuels my enthusiasm for data? It’s the thrill of diving deep into datasets, the challenge of transforming complex patterns into understandable insights, and the satisfaction of seeing those insights inform strategic decisions. I believe that in our data-driven world, the ability to interpret and utilize data is not just a skill, but a language that every industry should speak. Beyond my love for data, I’m an adventurer at heart. I’m always on the lookout for new challenges and learning opportunities, whether that’s mastering a new data visualization tool or exploring a new city. View My LinkedIn Profile

This is a simple exploratory data analysis on 5 stocks (AAPL, MSFT, GOOGL, META & JFU) - prediction, correlation, and risk assesmennt, using python libraries and machine learning algorithms.

Import libraries

# Import necessary libraries

import yfinance as yf

import pandas as pd

import numpy as np

from sklearn.model_selection import train_test_split

from sklearn.linear_model import LinearRegression

from sklearn.tree import DecisionTreeRegressor

from sklearn.ensemble import RandomForestRegressor

from sklearn.preprocessing import StandardScaler

from sklearn.decomposition import PCA

import matplotlib.pyplot as plt

from datetime import timedelta

import seaborn as sns

from statsmodels.tsa.seasonal import seasonal_decompose

Define the tickers

# Define the stocks to be fetched

symbols = ['AAPL', 'MSFT', 'GOOGL', 'META', 'JFU']

# Fetch stock data from Yahoo Finance

data = yf.download(symbols,'2020-01-01','2023-09-01')

print(data.head())

Adj Close Close \

AAPL GOOGL JFU META MSFT AAPL

Date

2020-01-02 73.249023 68.433998 190.0 209.779999 155.093674 75.087502

2020-01-03 72.536896 68.075996 190.0 208.669998 153.162460 74.357498

2020-01-06 73.114883 69.890503 190.0 212.600006 153.558380 74.949997

2020-01-07 72.771034 69.755501 190.0 213.059998 152.158279 74.597504

2020-01-08 73.941658 70.251999 187.0 215.220001 154.581924 75.797501

... Open \

GOOGL JFU META MSFT ... AAPL

Date ...

2020-01-02 68.433998 190.0 209.779999 160.619995 ... 74.059998

2020-01-03 68.075996 190.0 208.669998 158.619995 ... 74.287498

2020-01-06 69.890503 190.0 212.600006 159.029999 ... 73.447502

2020-01-07 69.755501 190.0 213.059998 157.580002 ... 74.959999

2020-01-08 70.251999 187.0 215.220001 160.089996 ... 74.290001

Volume \

GOOGL JFU META MSFT AAPL

Date

2020-01-02 67.420502 187.000000 206.750000 158.779999 135480400

2020-01-03 67.400002 182.199997 207.210007 158.320007 146322800

2020-01-06 67.581497 184.199997 206.699997 157.080002 118387200

2020-01-07 70.023003 196.199997 212.820007 159.320007 108872000

2020-01-08 69.740997 186.059998 213.000000 158.929993 132079200

GOOGL JFU META MSFT

Date

2020-01-02 27278000 2780 12077100 22622100

2020-01-03 23408000 30 11188400 21116200

2020-01-06 46768000 225 17058900 20813700

2020-01-07 34330000 4465 14912400 21634100

2020-01-08 35314000 520 13475000 27746500

[5 rows x 30 columns]

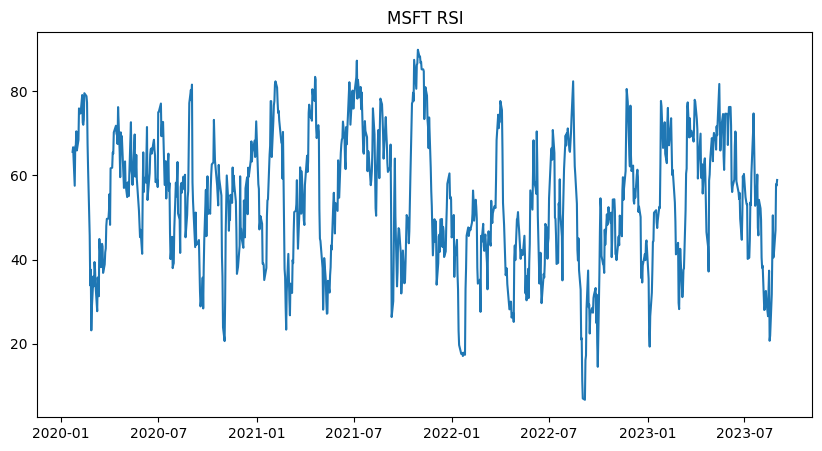

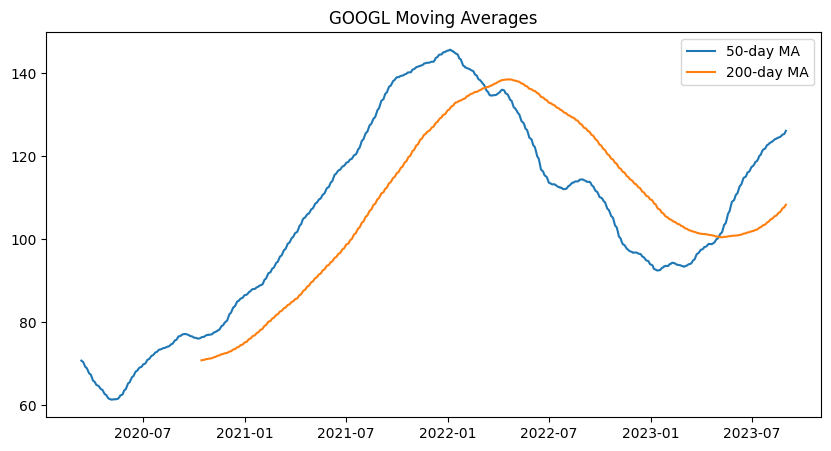

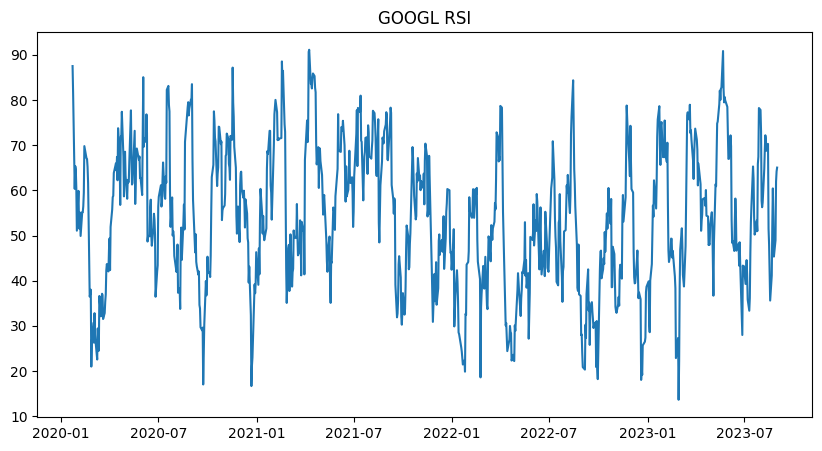

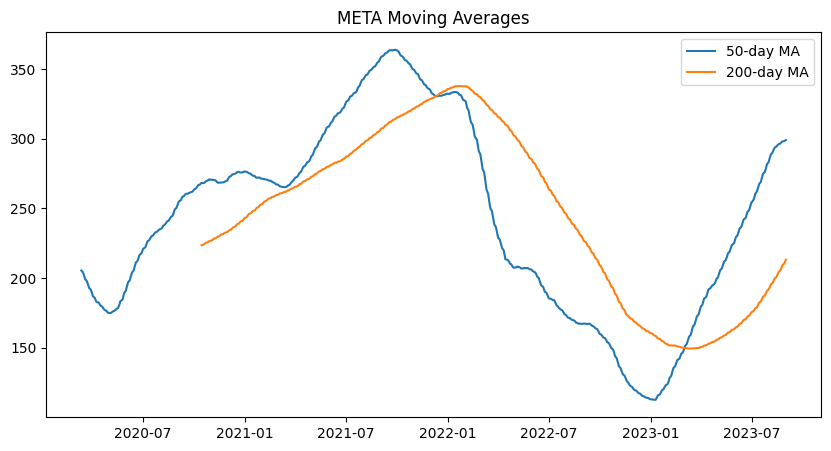

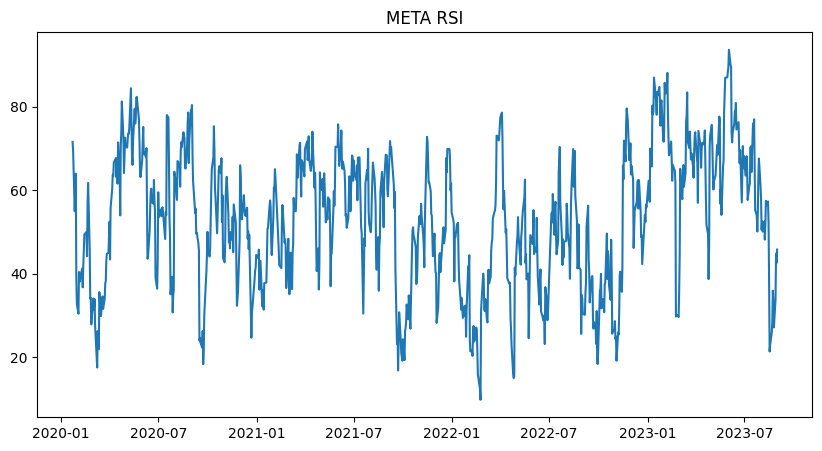

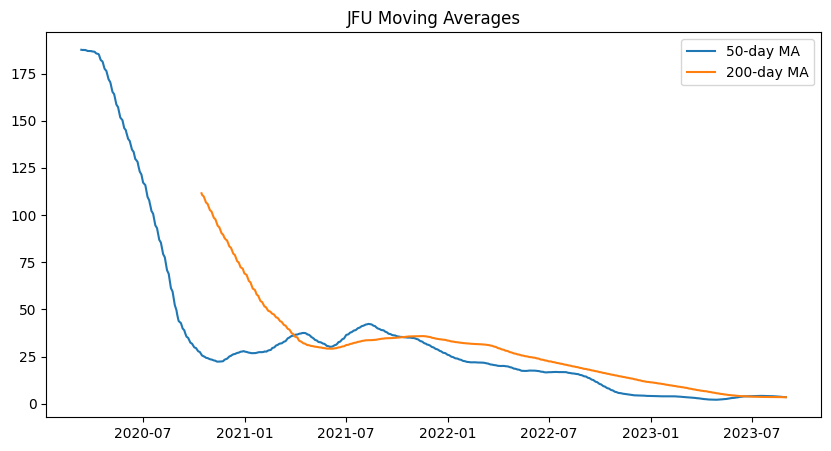

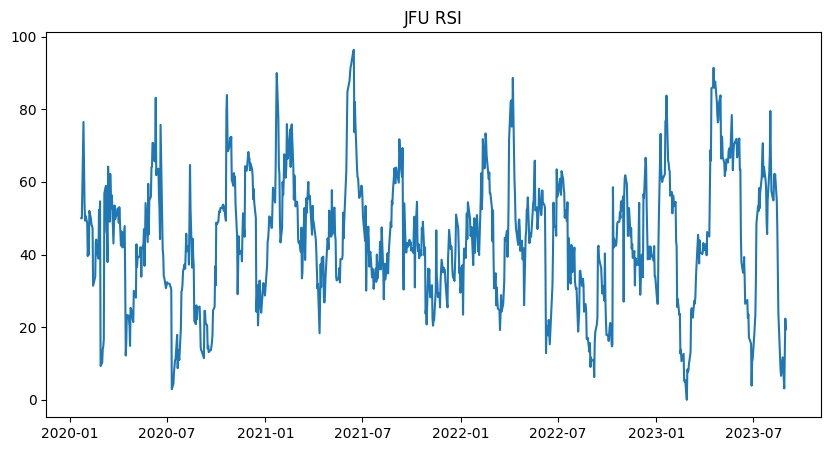

Moving averages and Relative Strength Index

# Calculate moving averages and RSI for each stock symbol

for symbol in symbols:

# Calculate 14-day RSI

delta = data['Close'][symbol].diff()

up, down = delta.copy(), delta.copy()

up[up < 0] = 0

down[down > 0] = 0

average_gain = up.rolling(window=14).mean()

average_loss = abs(down.rolling(window=14).mean())

rs = average_gain / average_loss

data[symbol+'_RSI'] = 100 - (100 / (1 + rs))

# Calculate 50-day moving average

data[symbol+'_MA50'] = data['Close'][symbol].rolling(window=50).mean()

# Calculate 200-day moving average

data[symbol+'_MA200'] = data['Close'][symbol].rolling(window=200).mean()

# Predict for the next 'n' days using linear regression, decision tree regressor, and random forest regressor

forecast_out = 30

# Create another column shifted 'n' units up for each stock symbol

for symbol in symbols:

data[symbol+'_Prediction'] = data['Close'][symbol].shift(-forecast_out)

Training Models

# Create the independent and dependent data sets for each stock symbol and train models

for symbol in symbols:

X = np.array(data.drop([symbol+'_Prediction'], 1))[:-forecast_out]

y = np.array(data[symbol+'_Prediction'].dropna())

# Split the data into 80% training and 20% testing

x_train, x_test, y_train, y_test = train_test_split(X, y, test_size=0.2)

# Standardize the features for better performance using StandardScaler

scaler = StandardScaler()

x_train_scaled = scaler.fit_transform(x_train)

x_test_scaled = scaler.transform(x_test)

# Fill NaN values with 0 because PCA contains NaN values, which causes errors

x_train_scaled = np.nan_to_num(x_train_scaled)

x_test_scaled = np.nan_to_num(x_test_scaled)

# Apply PCA for dimensionality reduction

#https://www.geeksforgeeks.org/dimensionality-reduction/

pca = PCA(n_components=2)

x_train_pca = pca.fit_transform(x_train_scaled)

x_test_pca = pca.transform(x_test_scaled)

#Linear Regression Model w/ PCA transformed data

lr = LinearRegression()

lr.fit(x_train_pca, y_train)

#Decision Tree Regressor Model w/ and PCA transformed data

tree = DecisionTreeRegressor()

tree.fit(x_train_pca, y_train)

#Random Forest Regressor Model w/ PCA transformed data

forest = RandomForestRegressor()

forest.fit(x_train_pca, y_train)

#Test the models

lr_confidence = lr.score(x_test_pca, y_test)

tree_confidence = tree.score(x_test_pca, y_test)

forest_confidence = forest.score(x_test_pca, y_test)

print(symbol + " Linear Regression Confidence: ", lr_confidence)

print(symbol + " Decision Tree Confidence: ", tree_confidence)

print(symbol + " Random Forest Confidence: ", forest_confidence)

#.iloc is not working

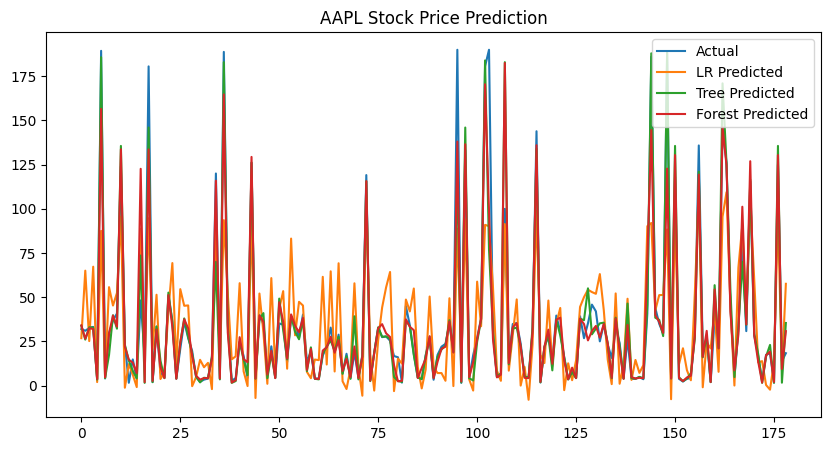

AAPL Linear Regression Confidence: 0.8693749526815797

AAPL Decision Tree Confidence: 0.9081605516537108

AAPL Random Forest Confidence: 0.9468460793945255

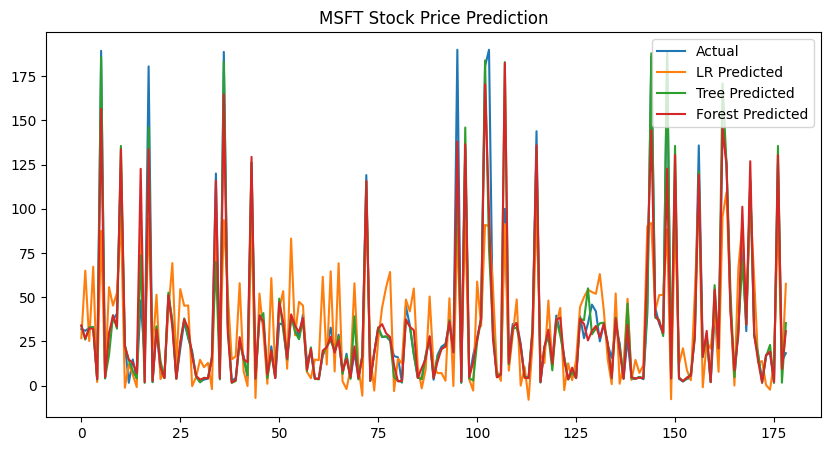

MSFT Linear Regression Confidence: 0.8035098620081532

MSFT Decision Tree Confidence: 0.8417873573839362

MSFT Random Forest Confidence: 0.9058770578190273

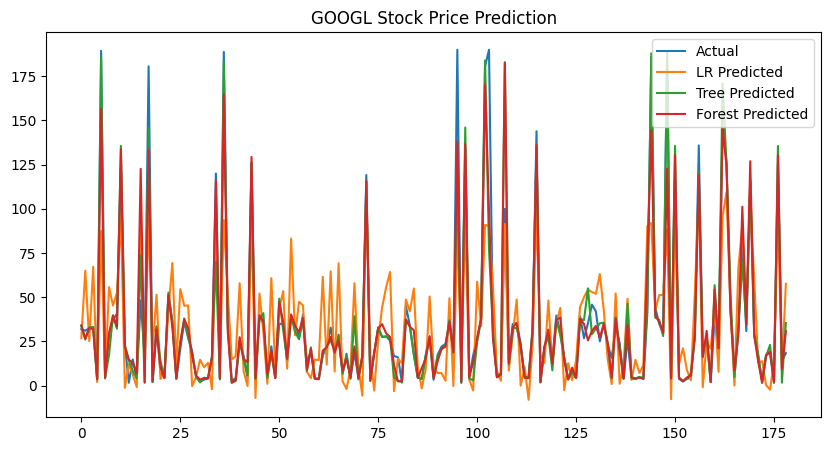

GOOGL Linear Regression Confidence: 0.8837169010119778

GOOGL Decision Tree Confidence: 0.9285290838698419

GOOGL Random Forest Confidence: 0.9503598628042024

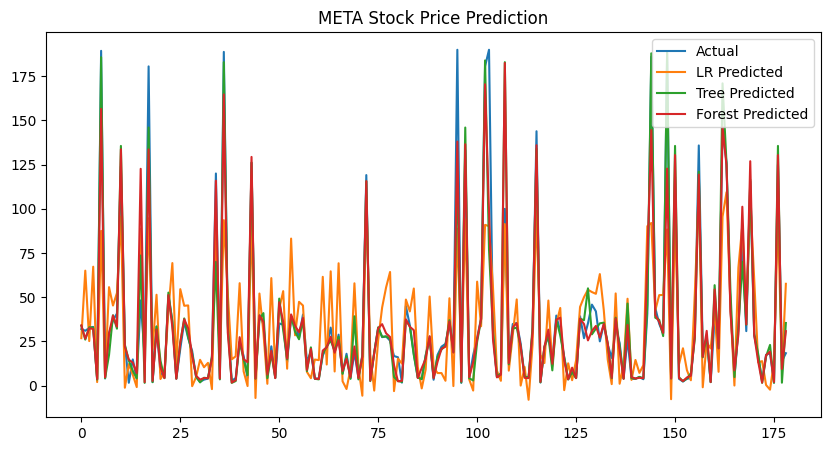

META Linear Regression Confidence: 0.7496966470619988

META Decision Tree Confidence: 0.8259379697861178

META Random Forest Confidence: 0.888153590092148

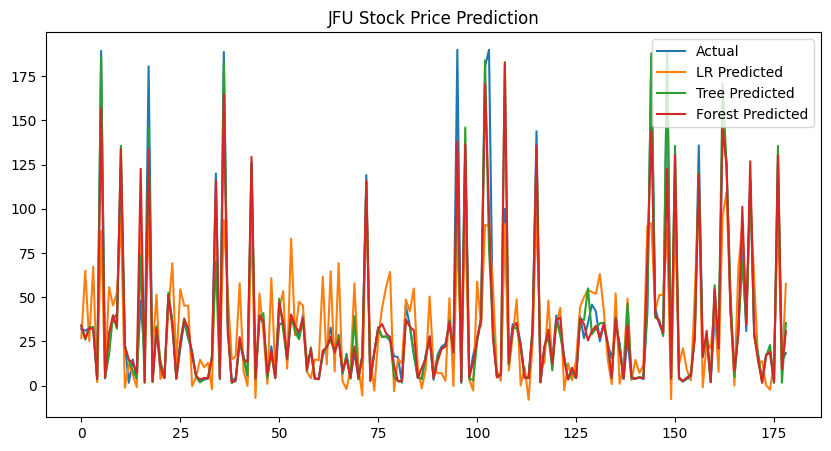

JFU Linear Regression Confidence: 0.6217064867191909

JFU Decision Tree Confidence: 0.9017686032831084

JFU Random Forest Confidence: 0.8934490293521452

Correlation

# Correlation Analysis

correlation_matrix = data.corr()

print("Correlation Matrix:")

print(correlation_matrix)

Correlation Matrix:

Adj Close \

AAPL GOOGL JFU META MSFT

Adj Close AAPL 1.000000 0.808847 -0.812810 0.181220 0.934111

GOOGL 0.808847 1.000000 -0.555156 0.504299 0.910637

JFU -0.812810 -0.555156 1.000000 -0.074040 -0.683986

META 0.181220 0.504299 -0.074040 1.000000 0.389772

MSFT 0.934111 0.910637 -0.683986 0.389772 1.000000

Close AAPL 0.999870 0.813587 -0.813391 0.191361 0.934948

GOOGL 0.808847 1.000000 -0.555156 0.504299 0.910637

JFU -0.812810 -0.555156 1.000000 -0.074040 -0.683986

META 0.181220 0.504299 -0.074040 1.000000 0.389772

MSFT 0.927045 0.918937 -0.676471 0.412579 0.999452

High AAPL 0.998769 0.810231 -0.816160 0.184809 0.930935

GOOGL 0.811826 0.998975 -0.558605 0.494979 0.910685

JFU -0.817450 -0.558369 0.997951 -0.070261 -0.687734

META 0.183317 0.505509 -0.076865 0.999045 0.391049

MSFT 0.928521 0.916743 -0.677260 0.404177 0.998250

Low AAPL 0.998872 0.814382 -0.811348 0.196924 0.935960

GOOGL 0.806415 0.999039 -0.553560 0.510244 0.908745

JFU -0.809815 -0.553197 0.998536 -0.077438 -0.681251

META 0.181600 0.504504 -0.075414 0.999107 0.389574

MSFT 0.925591 0.918989 -0.677049 0.419250 0.998011

Open AAPL 0.997534 0.810631 -0.814699 0.190835 0.931340

GOOGL 0.806978 0.997748 -0.553972 0.502339 0.907506

JFU -0.814353 -0.557352 0.996915 -0.075108 -0.684885

META 0.181448 0.503906 -0.075404 0.997885 0.388858

MSFT 0.926294 0.917250 -0.676686 0.411482 0.996508

Volume AAPL -0.624555 -0.549690 0.563616 -0.113204 -0.607588

GOOGL -0.254613 -0.279861 0.267165 -0.216487 -0.259348

JFU -0.063012 -0.058448 -0.018250 0.084874 -0.078593

META 0.116794 -0.023718 -0.139121 -0.378183 0.018999

MSFT -0.352783 -0.360663 0.389760 -0.240207 -0.346988

AAPL_RSI 0.035318 0.000714 0.046900 0.171164 0.083889

AAPL_MA50 0.946222 0.767983 -0.775098 0.037803 0.857990

AAPL_MA200 0.702043 0.293582 -0.678744 -0.506567 0.514397

MSFT_RSI -0.040280 0.040184 0.122060 0.217570 0.080183

MSFT_MA50 0.911519 0.900906 -0.621369 0.286948 0.945327

MSFT_MA200 0.676077 0.475340 -0.472934 -0.379071 0.551254

GOOGL_RSI -0.040077 0.066534 0.055768 0.296819 0.042943

GOOGL_MA50 0.768528 0.955724 -0.476635 0.341690 0.849788

GOOGL_MA200 0.524766 0.532932 -0.278908 -0.313685 0.468223

META_RSI 0.027726 -0.059726 -0.037907 0.124645 0.075835

META_MA50 0.161920 0.575963 0.019252 0.928316 0.383616

META_MA200 -0.082795 0.661437 0.711459 0.530259 0.187283

JFU_RSI 0.040179 0.068153 0.043307 0.094762 0.033651

JFU_MA50 -0.815882 -0.542873 0.957676 -0.010755 -0.640459

JFU_MA200 -0.626970 -0.229370 0.613811 0.338345 -0.506549

AAPL_Prediction 0.905793 0.758888 -0.825721 0.177138 0.896489

MSFT_Prediction 0.813605 0.826936 -0.656857 0.392515 0.905047

GOOGL_Prediction 0.746650 0.921140 -0.573907 0.564483 0.866042

META_Prediction 0.030167 0.314538 -0.060635 0.871229 0.253607

JFU_Prediction -0.754602 -0.484465 0.937591 -0.007773 -0.637924

Close ... \

AAPL GOOGL JFU META MSFT ...

Adj Close AAPL 0.999870 0.808847 -0.812810 0.181220 0.927045 ...

GOOGL 0.813587 1.000000 -0.555156 0.504299 0.918937 ...

JFU -0.813391 -0.555156 1.000000 -0.074040 -0.676471 ...

META 0.191361 0.504299 -0.074040 1.000000 0.412579 ...

MSFT 0.934948 0.910637 -0.683986 0.389772 0.999452 ...

Close AAPL 1.000000 0.813587 -0.813391 0.191361 0.928359 ...

GOOGL 0.813587 1.000000 -0.555156 0.504299 0.918937 ...

JFU -0.813391 -0.555156 1.000000 -0.074040 -0.676471 ...

META 0.191361 0.504299 -0.074040 1.000000 0.412579 ...

MSFT 0.928359 0.918937 -0.676471 0.412579 1.000000 ...

High AAPL 0.998902 0.810231 -0.816160 0.184809 0.924255 ...

GOOGL 0.816498 0.998975 -0.558605 0.494979 0.918760 ...

JFU -0.817934 -0.558369 0.997951 -0.070261 -0.680005 ...

META 0.193495 0.505509 -0.076865 0.999045 0.413884 ...

MSFT 0.929749 0.916743 -0.677260 0.404177 0.998559 ...

Low AAPL 0.998962 0.814382 -0.811348 0.196924 0.929374 ...

GOOGL 0.811206 0.999039 -0.553560 0.510244 0.917164 ...

JFU -0.810469 -0.553197 0.998536 -0.077438 -0.673875 ...

META 0.191720 0.504504 -0.075414 0.999107 0.412328 ...

MSFT 0.926944 0.918989 -0.677049 0.419250 0.998629 ...

Open AAPL 0.997662 0.810631 -0.814699 0.190835 0.924713 ...

GOOGL 0.811743 0.997748 -0.553972 0.502339 0.915825 ...

JFU -0.814945 -0.557352 0.996915 -0.075108 -0.677350 ...

META 0.191601 0.503906 -0.075404 0.997885 0.411650 ...

MSFT 0.927610 0.917250 -0.676686 0.411482 0.996997 ...

Volume AAPL -0.622801 -0.549690 0.563616 -0.113204 -0.601319 ...

GOOGL -0.256743 -0.279861 0.267165 -0.216487 -0.262104 ...

JFU -0.060859 -0.058448 -0.018250 0.084874 -0.075658 ...

META 0.113972 -0.023718 -0.139121 -0.378183 0.011195 ...

MSFT -0.355096 -0.360663 0.389760 -0.240207 -0.349023 ...

AAPL_RSI 0.037606 0.000714 0.046900 0.171164 0.089516 ...

AAPL_MA50 0.944717 0.767983 -0.775098 0.037803 0.847132 ...

AAPL_MA200 0.690636 0.293582 -0.678744 -0.506567 0.485361 ...

MSFT_RSI -0.038238 0.040184 0.122060 0.217570 0.088029 ...

MSFT_MA50 0.912779 0.900906 -0.621369 0.286948 0.943743 ...

MSFT_MA200 0.672875 0.475340 -0.472934 -0.379071 0.536411 ...

GOOGL_RSI -0.037870 0.066534 0.055768 0.296819 0.049627 ...

GOOGL_MA50 0.773316 0.955724 -0.476635 0.341690 0.857045 ...

GOOGL_MA200 0.526099 0.532932 -0.278908 -0.313685 0.464190 ...

META_RSI 0.025280 -0.059726 -0.037907 0.124645 0.072548 ...

META_MA50 0.174809 0.575963 0.019252 0.928316 0.411357 ...

META_MA200 -0.060665 0.661437 0.711459 0.530259 0.228475 ...

JFU_RSI 0.040680 0.068153 0.043307 0.094762 0.033582 ...

JFU_MA50 -0.816111 -0.542873 0.957676 -0.010755 -0.629473 ...

JFU_MA200 -0.612354 -0.229370 0.613811 0.338345 -0.474775 ...

AAPL_Prediction 0.904094 0.758888 -0.825721 0.177138 0.888316 ...

MSFT_Prediction 0.813076 0.826936 -0.656857 0.392515 0.902444 ...

GOOGL_Prediction 0.750773 0.921140 -0.573907 0.564483 0.872800 ...

META_Prediction 0.037728 0.314538 -0.060635 0.871229 0.272042 ...

JFU_Prediction -0.753689 -0.484465 0.937591 -0.007773 -0.628735 ...

META_MA50 META_MA200 JFU_RSI JFU_MA50 JFU_MA200 \

Adj Close AAPL 0.161920 -0.082795 0.040179 -0.815882 -0.626970

GOOGL 0.575963 0.661437 0.068153 -0.542873 -0.229370

JFU 0.019252 0.711459 0.043307 0.957676 0.613811

META 0.928316 0.530259 0.094762 -0.010755 0.338345

MSFT 0.383616 0.187283 0.033651 -0.640459 -0.506549

Close AAPL 0.174809 -0.060665 0.040680 -0.816111 -0.612354

GOOGL 0.575963 0.661437 0.068153 -0.542873 -0.229370

JFU 0.019252 0.711459 0.043307 0.957676 0.613811

META 0.928316 0.530259 0.094762 -0.010755 0.338345

MSFT 0.411357 0.228475 0.033582 -0.629473 -0.474775

High AAPL 0.171637 -0.056573 0.037188 -0.818885 -0.610901

GOOGL 0.570803 0.663344 0.066738 -0.546090 -0.232895

JFU 0.021621 0.692439 0.044026 0.956483 0.616604

META 0.930873 0.535614 0.091859 -0.011031 0.340872

MSFT 0.407087 0.229660 0.030570 -0.630104 -0.478053

Low AAPL 0.179355 -0.063893 0.041312 -0.814116 -0.611756

GOOGL 0.580997 0.661590 0.068134 -0.541859 -0.224310

JFU 0.017508 0.726888 0.034514 0.958333 0.603077

META 0.927794 0.528176 0.094965 -0.014675 0.337544

MSFT 0.416506 0.227835 0.033450 -0.630846 -0.470741

Open AAPL 0.176439 -0.059073 0.037981 -0.817246 -0.609477

GOOGL 0.577280 0.665574 0.066313 -0.541486 -0.226137

JFU 0.016277 0.713592 0.032099 0.958804 0.612142

META 0.930311 0.533171 0.092231 -0.012607 0.341115

MSFT 0.412755 0.232601 0.029818 -0.629993 -0.472029

Volume AAPL -0.029512 0.311282 -0.115423 0.585409 0.459886

GOOGL -0.151856 -0.042062 -0.000509 0.269240 0.012021

JFU 0.070368 -0.005490 0.199057 -0.031394 0.244835

META -0.292884 -0.111849 -0.022038 -0.076521 -0.189726

MSFT -0.155827 0.014748 -0.010755 0.385456 0.002669

AAPL_RSI 0.004997 -0.083463 0.061414 0.173290 -0.021741

AAPL_MA50 0.125853 -0.024119 0.064262 -0.834666 -0.659242

AAPL_MA200 -0.465743 -0.191395 -0.203036 -0.610332 -0.854299

MSFT_RSI 0.094668 -0.049461 0.125818 0.128754 0.010838

MSFT_MA50 0.378591 0.334035 0.020917 -0.664905 -0.475025

MSFT_MA200 -0.250226 0.161366 -0.221518 -0.371834 -0.628478

GOOGL_RSI 0.143009 -0.062768 0.266579 0.119583 0.129097

GOOGL_MA50 0.487623 0.701526 0.015801 -0.540144 -0.277905

GOOGL_MA200 -0.143979 0.361218 -0.222673 -0.154512 -0.477958

META_RSI -0.178882 -0.382929 0.213837 0.096464 -0.180302

META_MA50 1.000000 0.726746 0.075377 -0.025740 0.416205

META_MA200 0.726746 1.000000 -0.029005 0.808407 0.393725

JFU_RSI 0.075377 -0.029005 1.000000 -0.078887 0.139101

JFU_MA50 -0.025740 0.808407 -0.078887 1.000000 0.585410

JFU_MA200 0.416205 0.393725 0.139101 0.585410 1.000000

AAPL_Prediction 0.154719 -0.116911 0.050904 -0.767557 -0.562317

MSFT_Prediction 0.393056 0.117118 0.116782 -0.571668 -0.458296

GOOGL_Prediction 0.642517 0.590318 0.119955 -0.507234 -0.164358

META_Prediction 0.768514 0.307906 0.121921 0.112358 0.293471

JFU_Prediction 0.157141 0.619181 -0.001170 0.870422 0.631696

AAPL_Prediction MSFT_Prediction GOOGL_Prediction \

Adj Close AAPL 0.905793 0.813605 0.746650

GOOGL 0.758888 0.826936 0.921140

JFU -0.825721 -0.656857 -0.573907

META 0.177138 0.392515 0.564483

MSFT 0.896489 0.905047 0.866042

Close AAPL 0.904094 0.813076 0.750773

GOOGL 0.758888 0.826936 0.921140

JFU -0.825721 -0.656857 -0.573907

META 0.177138 0.392515 0.564483

MSFT 0.888316 0.902444 0.872800

High AAPL 0.902242 0.808978 0.747621

GOOGL 0.761884 0.827124 0.920396

JFU -0.827379 -0.659121 -0.575090

META 0.178862 0.393142 0.566163

MSFT 0.889261 0.901329 0.871056

Low AAPL 0.905171 0.816284 0.754114

GOOGL 0.756282 0.825561 0.921340

JFU -0.823885 -0.654967 -0.573221

META 0.177900 0.393422 0.565503

MSFT 0.887989 0.903551 0.875149

Open AAPL 0.901991 0.810980 0.749967

GOOGL 0.756654 0.824351 0.920219

JFU -0.825333 -0.657569 -0.575928

META 0.176973 0.391980 0.565510

MSFT 0.887448 0.900908 0.872671

Volume AAPL -0.626398 -0.582726 -0.542105

GOOGL -0.229806 -0.209844 -0.240269

JFU -0.048769 -0.053369 -0.009978

META 0.099013 0.022033 -0.050103

MSFT -0.347067 -0.322639 -0.344415

AAPL_RSI 0.074507 0.073339 -0.002312

AAPL_MA50 0.855150 0.734534 0.689212

AAPL_MA200 0.553604 0.311595 0.062163

MSFT_RSI 0.008674 0.093762 0.064315

MSFT_MA50 0.855360 0.826590 0.830611

MSFT_MA200 0.508154 0.284234 0.185333

GOOGL_RSI -0.038234 0.025180 0.026912

GOOGL_MA50 0.707865 0.749496 0.868290

GOOGL_MA200 0.417426 0.256289 0.255506

META_RSI 0.076715 0.084179 -0.047988

META_MA50 0.154719 0.393056 0.642517

META_MA200 -0.116911 0.117118 0.590318

JFU_RSI 0.050904 0.116782 0.119955

JFU_MA50 -0.767557 -0.571668 -0.507234

JFU_MA200 -0.562317 -0.458296 -0.164358

AAPL_Prediction 1.000000 0.920492 0.801033

MSFT_Prediction 0.920492 1.000000 0.915262

GOOGL_Prediction 0.801033 0.915262 1.000000

META_Prediction 0.177418 0.411891 0.502900

JFU_Prediction -0.798886 -0.634606 -0.519674

META_Prediction JFU_Prediction

Adj Close AAPL 0.030167 -0.754602

GOOGL 0.314538 -0.484465

JFU -0.060635 0.937591

META 0.871229 -0.007773

MSFT 0.253607 -0.637924

Close AAPL 0.037728 -0.753689

GOOGL 0.314538 -0.484465

JFU -0.060635 0.937591

META 0.871229 -0.007773

MSFT 0.272042 -0.628735

High AAPL 0.030154 -0.756083

GOOGL 0.304948 -0.488231

JFU -0.053531 0.932589

META 0.869779 -0.010799

MSFT 0.261974 -0.630449

Low AAPL 0.045010 -0.751130

GOOGL 0.320520 -0.481783

JFU -0.065133 0.937953

META 0.871829 -0.007432

MSFT 0.280288 -0.627680

Open AAPL 0.037368 -0.754327

GOOGL 0.312320 -0.483112

JFU -0.060237 0.933641

META 0.870129 -0.007856

MSFT 0.269696 -0.628188

Volume AAPL -0.086503 0.481669

GOOGL -0.157585 0.227012

JFU 0.138511 -0.026518

META -0.352766 -0.179062

MSFT -0.214908 0.315142

AAPL_RSI 0.232205 -0.042733

AAPL_MA50 -0.186797 -0.723826

AAPL_MA200 -0.605863 -0.745617

MSFT_RSI 0.321655 0.096550

MSFT_MA50 0.023581 -0.576966

MSFT_MA200 -0.575541 -0.568458

GOOGL_RSI 0.359674 0.066181

GOOGL_MA50 0.076250 -0.408025

GOOGL_MA200 -0.517346 -0.425543

META_RSI 0.232550 -0.084670

META_MA50 0.768514 0.157141

META_MA200 0.307906 0.619181

JFU_RSI 0.121921 -0.001170

JFU_MA50 0.112358 0.870422

JFU_MA200 0.293471 0.631696

AAPL_Prediction 0.177418 -0.798886

MSFT_Prediction 0.411891 -0.634606

GOOGL_Prediction 0.502900 -0.519674

META_Prediction 1.000000 -0.040691

JFU_Prediction -0.040691 1.000000

[50 rows x 50 columns]

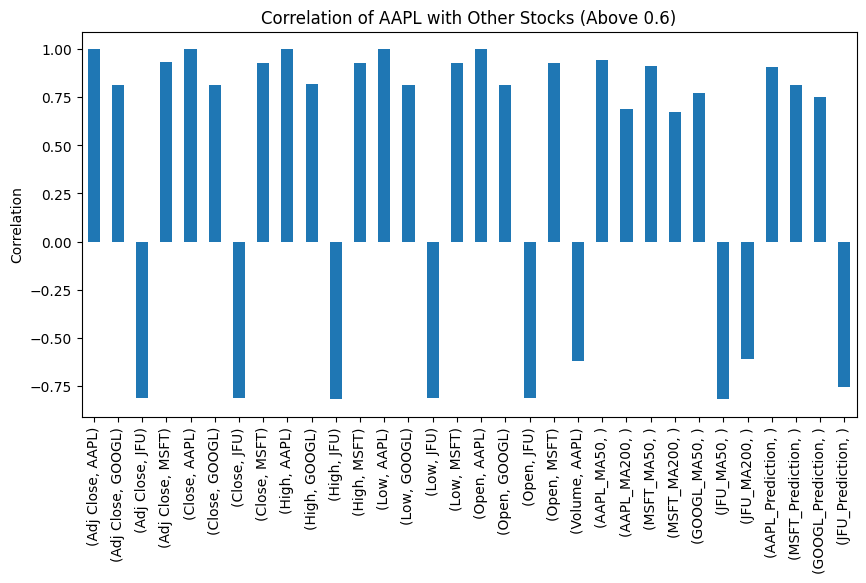

Plot correlation matrix with specified threshold

# Filter correlations for 'AAPL' above a threshold

threshold = 0.6

aapl_correlations = correlation_matrix['Close']['AAPL'][correlation_matrix['Close']['AAPL'].abs() > threshold]

# Plot 'AAPL' correlations

plt.figure(figsize=(10, 5))

aapl_correlations.plot(kind='bar')

plt.title('Correlation of AAPL with Other Stocks (Above 0.6)')

plt.ylabel('Correlation')

plt.show()

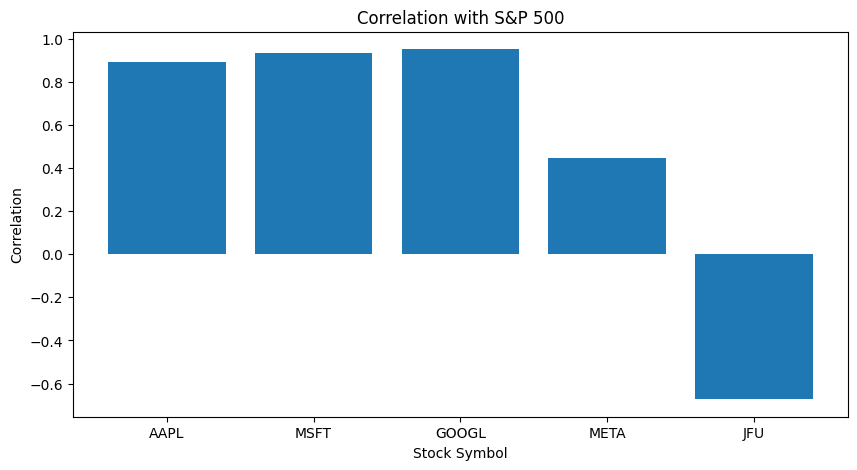

Benchmarking performance agaisnt S&P500

# Performance Measurement against S&P 500 Index

benchmark_data = yf.download('SPY','2020-01-01','2023-09-01')['Close']

for symbol in symbols:

correlation_with_benchmark = data['Close'][symbol].corr(benchmark_data)

print(symbol + " Correlation with S&P 500: ", correlation_with_benchmark)

[******100%%*******] 1 of 1 completed AAPL Correlation with S&P 500: 0.8900998247068898 MSFT Correlation with S&P 500: 0.9329114322662561 GOOGL Correlation with S&P 500: 0.95062462020499 META Correlation with S&P 500: 0.44587757367253394 JFU Correlation with S&P 500: -0.6723668544261696

# Performance measurement

benchmark_corr = [data['Close'][symbol].corr(benchmark_data) for symbol in symbols]

plt.figure(figsize=(10, 5))

plt.bar(symbols, benchmark_corr)

plt.title('Correlation with S&P 500')

plt.xlabel('Stock Symbol')

plt.ylabel('Correlation')

plt.show()

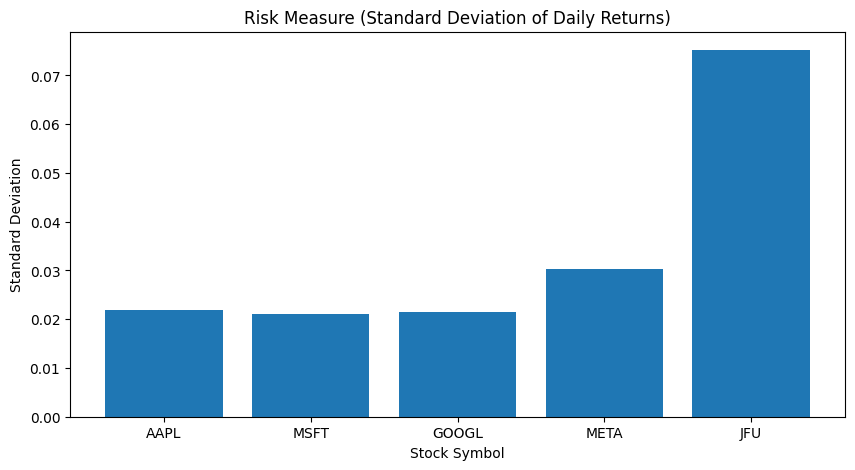

Risk Analysis

# Risk Analysis

for symbol in symbols:

daily_returns = data['Close'][symbol].pct_change().dropna()

risk_measure_std_deviation = daily_returns.std()

print(symbol + " Risk Measure (Standard Deviation of Daily Returns): ", risk_measure_std_deviation)

AAPL Risk Measure (Standard Deviation of Daily Returns): 0.021819554790903452 MSFT Risk Measure (Standard Deviation of Daily Returns): 0.021118552747592577 GOOGL Risk Measure (Standard Deviation of Daily Returns): 0.021448103080327605 META Risk Measure (Standard Deviation of Daily Returns): 0.030356263394661093 JFU Risk Measure (Standard Deviation of Daily Returns): 0.07520947731438413

# Risk measurement

risk_measure_std_deviation = [data['Close'][symbol].pct_change().dropna().std() for symbol in symbols]

plt.figure(figsize=(10, 5))

plt.bar(symbols, risk_measure_std_deviation)

plt.title('Risk Measure (Standard Deviation of Daily Returns)')

plt.xlabel('Stock Symbol')

plt.ylabel('Standard Deviation')

plt.show()

Volatility measure (need to update metrics)

# Calculate daily returns and volatility for each stock symbol

for symbol in symbols:

# Calculate daily returns

data[symbol, 'Return'] = data['Close'][symbol].pct_change()

# Calculate volatility as the standard deviation of returns

volatility = np.std(data[symbol, 'Return'])

# Assess volatility

if volatility < 0.01:

print(symbol + " is not volatile.")

elif volatility < 0.02:

print(symbol + " is moderately volatile.")

else:

print(symbol + " is very volatile.")

AAPL is very volatile. MSFT is very volatile. GOOGL is very volatile. META is very volatile. JFU is very volatile.

Summary and data visualization

# Summary statistics

for symbol in symbols:

print(data[symbol].describe())

::: Return count 922.000000 mean 0.001233 std 0.021820 min -0.128647 25% -0.009473 50% 0.000776 75% 0.013371 max 0.119808 Return count 922.000000 mean 0.000997 std 0.021119 min -0.147390 25% -0.009659 50% 0.000642 75% 0.012283 max 0.142169 Return count 922.000000 mean 0.000976 std 0.021448 min -0.116341 25% -0.009595 50% 0.001072 75% 0.012120 max 0.092412 Return count 922.000000 mean 0.000843 std 0.030356 min -0.263901 25% -0.012657 50% 0.000683 75% 0.015070 max 0.232824 Return count 922.000000 mean -0.001938 std 0.075209 min -0.338109 25% -0.038044 50% -0.004408 75% 0.025286 max 0.836842

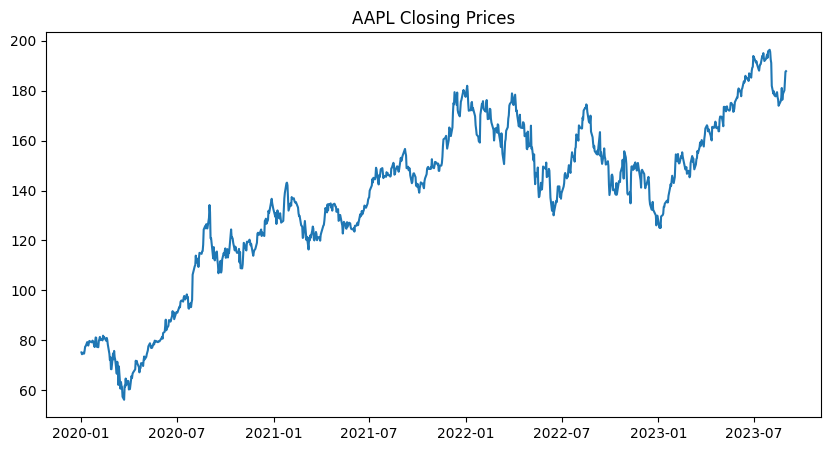

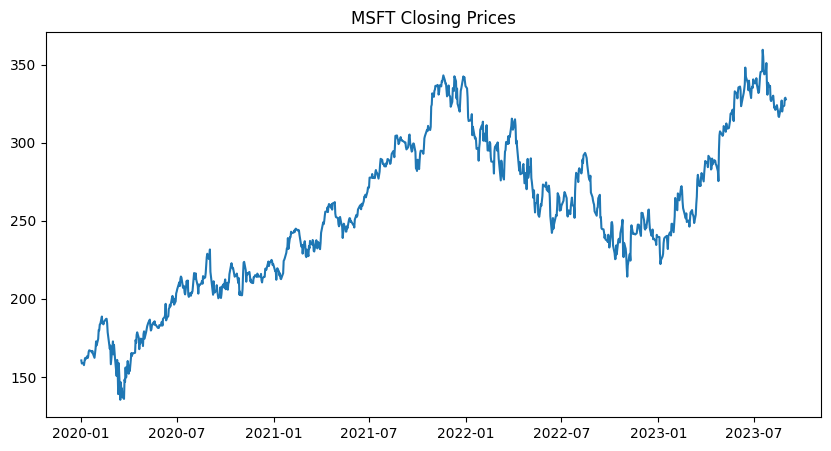

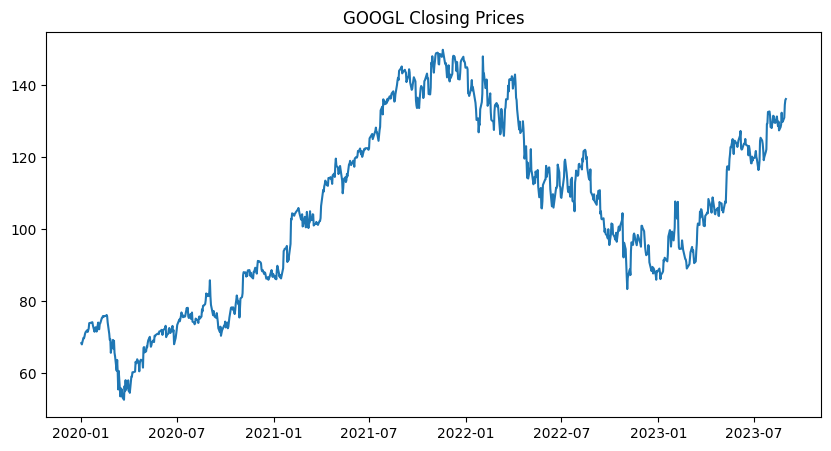

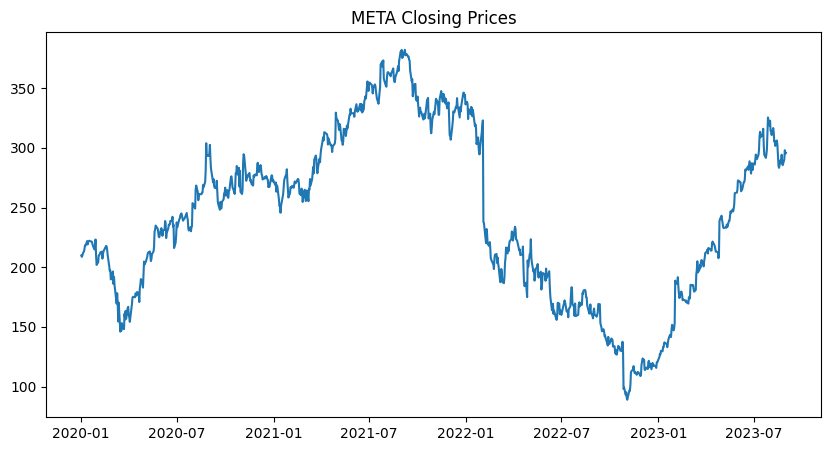

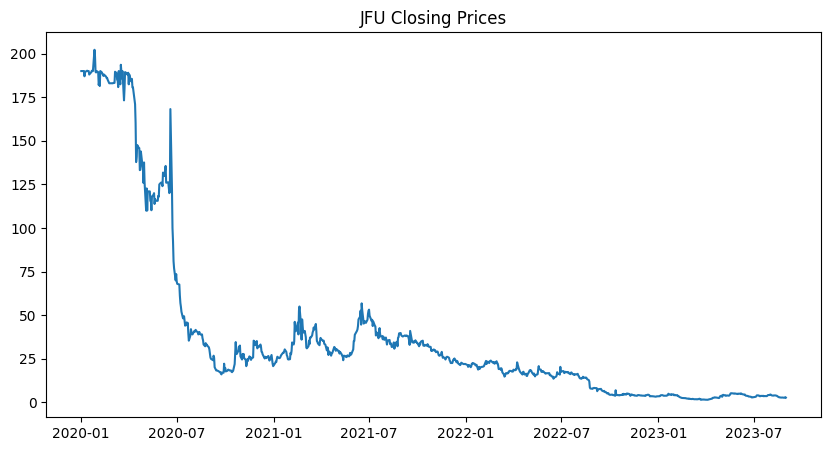

# Plot closing prices over time

for symbol in symbols:

plt.figure(figsize=(10, 5))

plt.plot(data['Close'][symbol])

plt.title(symbol + ' Closing Prices')

plt.show()

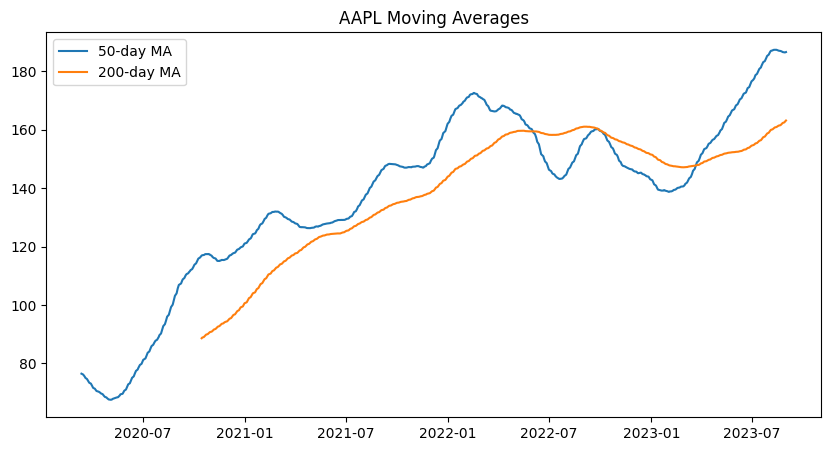

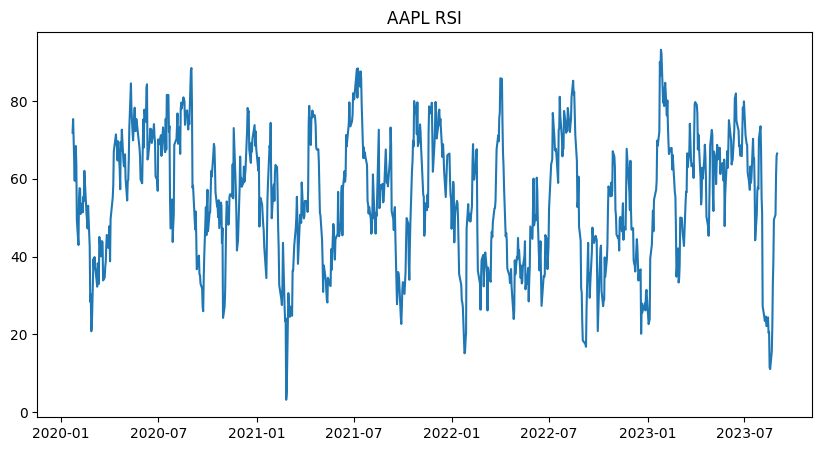

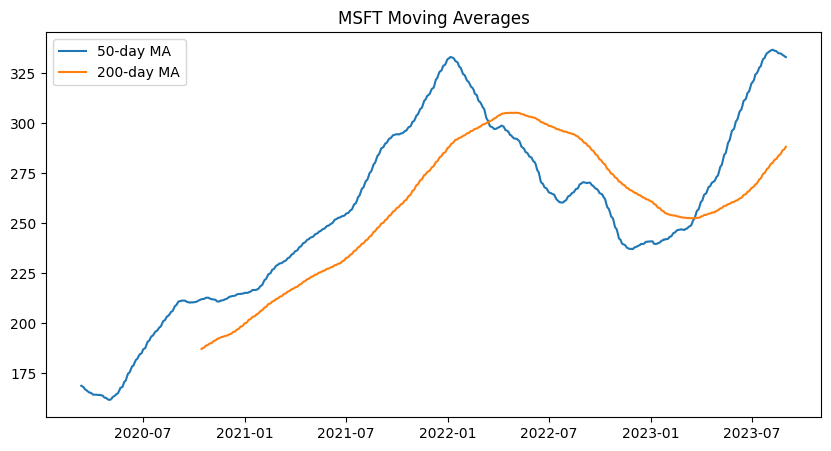

# Plot moving averages and RSI over time

for symbol in symbols:

plt.figure(figsize=(10, 5))

plt.plot(data[symbol+'_MA50'], label='50-day MA')

plt.plot(data[symbol+'_MA200'], label='200-day MA')

plt.title(symbol + ' Moving Averages')

plt.legend()

plt.show()

plt.figure(figsize=(10, 5))

plt.plot(data[symbol+'_RSI'])

plt.title(symbol + ' RSI')

plt.show()

# Compare actual vs predicted prices

for symbol in symbols:

lr_pred = lr.predict(x_test_pca)

tree_pred = tree.predict(x_test_pca)

forest_pred = forest.predict(x_test_pca)

plt.figure(figsize=(10, 5))

plt.plot(y_test, label='Actual')

plt.plot(lr_pred, label='LR Predicted')

plt.plot(tree_pred, label='Tree Predicted')

plt.plot(forest_pred, label='Forest Predicted')

plt.title(symbol + ' Stock Price Prediction')

plt.legend()

plt.show()